Hello apes, I bring you a sad news. OG DD writer and appreciated member of the community ( that Ein Man that Fachs ) got perma-suspended...

a proponent of DRS, a proponent of GME, a proponent of the fediverse and freedom of communication.

GameStop company turnaround - current status as of Q3 2024

GameStop Company Turnaround

Since 2021, GameStop has been undergoing a transformation: fewer stores, higher value, renewed profitability

By June 2021, Ryan Cohen and the new board of directors were in the position to initiate the turnaround of the company. This has involved extensive cutting of costs, closing of stores, and modernization of a company that had previously failed to adapt with the modern era.

"We inherited a bunch of legacy everything, and under-investment across the entire business –- people, the entire technology stack, just decades of neglect, and so it’s hard to turn around a brick and mortar retailer that’s under the kind of pressure that GameStop was and continues to be under,

GME ownership update (as of June 30, 2024)

Institutional ownership increased from 87.4 M shares as of June 13 to 97.6 M shares as of June 30

GameStop company ownership as of June 13, 2024

GameStop stockholders' equity after 2 recent ATMs

GameStop ATM equity offering versus share value (May 1 to May 24)

On May 17 GameStop announced plans to sell up to 45 million shares, and on May 24th they announced that all 45 million shares were sold for $933 million, at an average price of about $20.73.

Modifying shares outstanding from 306 million to 351 million is an approximately 15% dilution. A shareholder could have expected the value of their own share holdings to have dropped 15% from this action, but shareholder value hardly went down at all as a consequence of the dilution and in fact is up about 75% from May 1 to May 24.

Reddit as a whole continues to demonstrate corrupt acts of information control against the interest of Reddit's users.

Imagine being a shareholder of any company but not allowed to have a voice in shareholder social media communities because the unaccountable moderators / admins of those communities decided that you don't get a voice. how fucked up is that? this is the power that reddit has over shareholders of companies that have nothing to do with Reddit. it's one of the reasons i have reluctantly found myself using X more. X too suffers from problems but not censorship the way reddit does.

i of course would ultimately love to see more users on Lemmy and other fediverse apps, but most people are not really interested in this right now. maybe as the enshittification of reddit gets unbearable, more people will consider Lemmy

r/GME does not allow any linking to DRSGME.org

was trying to post something to r/GME and had used a page on the DRSGME.org website as a source.

Specifically, it was the 2023 stockholder list viewing page that I had wanted to use a source because it is a good source. It is pretty much the only source of data that GME shareholders have that provide numbers about DRS versus DSPP. An imperfect, out-of-date set of data, sure, but it's all we've got.

Turns out, r/GME will not allow any linking to DRSGME.org.

Why would that be?

A free information website built by GME shareholders for other GME shareholders and anyone else, is not permitted in the r/GME subreddit. Huh?

GameStop Company Ownership: table and chart (as of May 24, 2024)

GameStop Company Ownership as of May 24, 2024

As of March 20, 2024 there were 305,873,200 shares of GameStop's Class A common stock (GME) outstanding.

"Of those outstanding shares, approximately 230.6 million were held by Cede & Co on behalf of the Depository Trust & Clearing Corporation (or approximately 75% of our outstanding shares) and approximately 75.3 million shares of our Class A common stock were held by registered holders with our transfer agent (or approximately 25% of our outstanding shares)."

As of May 24, 2024, GameStop completed an at the market equity offering, and sold 45,000,000 shares, increasing the total amount of share

| Before ATM | After ATM (May 24) | |

|---|---|---|

| Shares outstanding (approx) | 305,000,000 | 350,000,000 |

| Cash on hand (approx) | $1 billion | $2 billion |

| DRS % of outstanding shares (approx 75 million DRS) | 24.7% | 21.4% |

GameStop Completes At-The-Market Equity Offering Program

May 24, 2024

GRAPEVINE, Texas, May 24, 2024 (GLOBE NEWSWIRE) -- GameStop Corp. (NYSE: GME) (“GameStop” or the “Company”) today announced that it has completed its previously disclosed “at-the-market” equity offering program (the “ATM Program”).

GameStop disclosed on May 17, 2024 that it filed a prospectus supplement with the U.S Securities and Exchange Commission to offer and sell up to a maximum amount of 45,000,000 shares of its common stock from time to time through the ATM Program. The Company sold the maximum number of shares registered under the ATM Program for aggregate gross proceeds (before commissions and offering expenses) of approximately $933.4 million.

GameStop intends to use the net proceeds from the ATM Program for general corporate purposes, which may include acquisitions and investments.

Einfachman canceled by Reddit

Hello apes, I bring you a sad news. OG DD writer and appreciated member of the community ( that Ein Man that Fachs ) got perma-suspended...

cross-posted from: https://lemmy.whynotdrs.org/post/1455429

when superstonk isn't a problem, Reddit is.

Apparently, with no warning or justification, prominent superstonk poster of many years was spontaneously banned after having written this post titled: We’re Not In MOASS Territory (yet)

GAMESTOP to the MOON - How Reddit almost triggered an Economic Crisis | FD Finance - a review

Click to view this content.

Noticed this post on reddit, decided to give this >40 minute documentary a watch.

A review of GAMESTOP to the MOON - How Reddit almost triggered an Economic Crisis | FD Finance

★★☆☆☆

2/5, would not recommend.

TLDR: documentary focuses primarily on the events of late 2020 and early 2021, conflates AMC and GME as equivalent things, concludes with the insinuation that all AMC, GME, and NFT investors are losers that have lost almost everything

never left, not leaving. will be buying more shares and putting them in my name

thanks for your concern though

GameStop employee count compared with store count, and compared with SG&A, by fiscal year

GameStop FY23 Income Statement visualized, operating loss edition

Here is another representation of GameStop's FY23 income statement, this time showing clearly that GameStop had an operating loss of $34.5 M ( compared with an operating loss of $311 M FY22 !)

If not for the $49.5 M from interest income, GameStop would not have had positive net earnings in FY23.

GameStop FY 2023 Income Statement visualized

Operating loss of $35 M (compared with operating loss of $312 M in FY22)

Small but notable net earnings of $6.7 M (compared with net loss of $313 M in FY22)

How did GameStop make $50 million in interest income?

The April 2024 state of financial media versus GameStop being profitable for the first time in 6 years.

GameStop reported full-year profitability for fiscal year 2023, contradicting the prevailing media sentiment that GameStop is a terrible company destined for bankruptcy

From a histori

you could sell directly from computershare into a Wise account

FY 2023 Full-year profitability versus PE ratios

For the first 3 quarters of FY 2023, GameStop has posted a total net loss of $56.4 million.

Therefore, in order to achieve full-year profitability, GameStop must achieve greater than $56.4 million in net profit for Q4 2023.

This is certainly achievable, though not guaranteed.

Something like a $100 million net gain for Q4 is possible, but not necessarily very likely.

Therefore, in any case of full-year profitability, at best, the PE ratio for GME will almost certainly be above 100, but will more likely be in the several hundreds, or worse.

By comparison, the average PE ratio for S&P500 is around 25.

https://www.macrotrends.net/2577/sp-500-pe-ratio-price-to-earnings-chart

Some PE ratios of other companies:

TLDR: Full-year profitability will be a momentous achievement, but in almost all cases, GME would have a very high PE ratio. Over the following quarters / years, GameStop

it may very well be one of the last good opportunities to get some GME for cheap.

Either GameStop achieves full-year profitability, or they don't.

GameStop's opponents (those hedge funds and other participants holding a short position seeking the stock price to go down), and their useful bought and paid for media puppets, are well aware of the situation we are in, probably even more aware than most GME shareholders.

Full-year profitability is the target. It's the thing that most shareholders and opponents have their mind on, in terms of material things that matter that could change the narrative, change the dynamic, and ultimately lead towards true price discovery.

If GameStop fails to achieve full year profitability, (e.g. net quarterly earnings for 2023 Q4 to be any amount less than positive ~ $57 million), then this will give the opponents an opportunity to pile on negative sentiment and hit the price down. "After 3 years in control of the company, Ryan Cohen and team fail to achieve widely-expected profitability, stock price down XX %". As a shareholder I obviously hope that this is not the outcome, but I'll be happy with any general improvements to the company's financial standing.

but I think that this is a very achievable target. Net positive $57 million for 2023 Q4 will give full-year profitability for FY 2023. Any number above that is a major success, and completely feasible. Not guaranteed by any means, but realistically achievable.

And if this is achieved, then it shoots a giant hole in the persistent negative media narrative that has been put upon GameStop these past few years by dishonest and manipulative wall street incumbents and their dishonest and manipulative friends in the financial media.

in the scenario of full-year profitability, some positives with respect to an investment in GME:

Obviously, not everything is sunshine and rainbows. GameStop still faces headwinds and has many competitors. In the long term, GameStop also needs to dramatically grow top-line revenue if it ever wants to become the giant that many shareholders believe it to be. These are not small accomplishments.

In the short term, in the face of the achievement of full-year profitability, and all the other positives that GameStop has going for it, how can the media sentiment towards GameStop continue to be so negative and cynical? Surely they will try, but it will become increasingly untenable to try and spin negativity about a situation that is very obviously positive. The negative media narrative is there to try and prevent additional investors from ever considering GME as a valid investment. But at some point the truth of the fundamentals become more powerful than the lies of the media. All it will take is some significant buying pressure and the price could break out.

Who knows what will happen.

I hope GameStop reports $57 million or more in net earnings for Q4 2023. We'll find out in less than 2 weeks.

i disagree with the assertion that heat lamp has been debunked, though it seems like some people really want people to necessarily believe this to be true and final.

put aside the name "heatlamp theory" and address 2 of the main points:

Okay, so heat lamp as originally proposed might not be the fully accurate explanation for the volume spikes. So what are the alternative explanations then?

Something worth noting is that there seems to be a very effortful push to authoritatively declare "DEBUNKED!" without explaining specifically how it is debunked, and without providing any alternative explanations.

Plan is not DRS is a true statement and is not debunked.

GME has unusual trading volume on some DRS record dates, this is another true observation that is not debunked.

One theory that attempts to tie these things together might not be completely accurate but to my awareness is the most thoughtful explanation that exists thus far. I'd love to see alternative explanations but I don't know of any. Superstonk mods by consensus are opposed to the notion that there is any validity to heatlamp theory, yet offer absolutely nothing else as an alternative.

TLDR: "heatlamp is debunked" is just another example of narrative control being perpetrated by a group of moderators of the largest GME internet community. More information is needed to make any kinds of authoritative claims.

exciting!

with respect to GME, filing date for Q4 is usually mid March

| Quarter | Filing Date | Document Date |

|---|---|---|

| Q4 2022 | March 21, 2023 | January 28, 2023 |

| Q4 2021 | March 17, 2022 | January 29, 2022 |

| Q4 2020 | March 23, 2021 | January 30, 2021 |

| Q4 2019 | March 26, 2020 | February 1, 2020 |

| Q4 2018 | April 2, 2019 | February 2, 2019 |

Updated image, original image was missing Technology Brands stores for FY 2013.

GameStop Store Count by Fiscal Year

Breakdown of GameStop stores by Technology Brands stores versus Video Game Brands stores versus all International stores

GameStop Store Count by Fiscal Year

And for fun,

GameStop Net Income Per Store

| Fiscal Year | Revenue | Net Income | Store Count | Revenue Per Store | Net Income Per Store | 10-K |

|---|---|---|---|---|---|---|

| 2005 | $3,091,783,000 | $100,784,000 | 4490 | $688,593.10 | $22,446.33 | link |

| 2006 | $5,318,900,000 | $158,250,000 | 4778 | $1,113,206.36 | $33,120.55 | link |

| 2007 | $7,093,962,000 | $288,291,000 | 5264 | $1,347,637.16 | $54,766.53 | link |

| 2008 | $8,805,897,000 |

The link is in the post, they are all on that page, but here:

As a reminder, shareholder proposals are submitted by real people with real names. As a matter of courtesy it would be appropriate to respect the privacy of these individuals as much as possible.

And to my awareness, it does not matter which country a shareholder resides in, the qualifications to submit a proposal are only that a shareholder has held a minimum dollar value of shares for a minimum amount of time, as specified here:

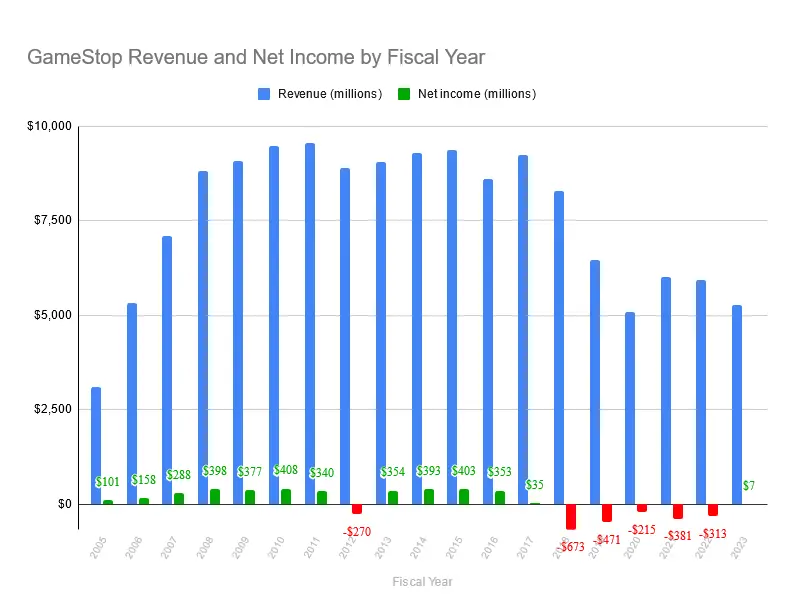

GameStop Revenue and Net Income by Fiscal Year

| Fiscal Year | Revenue | Net Income | Store Count | Revenue Per Store | Net Income Per Store | 10-K |

|---|---|---|---|---|---|---|

| 2005 | $3,091,783,000 | $100,784,000 | 4490 | $688,593.10 | $22,446.33 | link |

| 2006 | $5,318,900,000 | $158,250,000 | 4778 | $1,113,206.36 | $33,120.55 | link |

| 2007 | $7,093,962,000 | $288,291,000 | 5264 | $1,347,637.16 | $54,766.53 | link |

| 2008 | $8,805,897,000 | $398,282,000 | 6207 | $1,418,704.20 | $64,166.59 | [link ](https://www.sec.gov/Archives/edgar/data/1326380/000095013409006 |

Cheers to the activists! 🍻

As many are aware, the SEC recently published Incoming No-Action Requests Under Exchange Act Rule 14a-8, and there were several shareholder proposals submitted by GME shareholders that were rejected by the company that were published there.

There have already been a few discussions of these proposals on Reddit and on X and on Discord at least.

Some of the discussions about the rejected proposals have been nothing but negative and cynical and even disparaging towards those shareholders that submitted proposals.

So I just wanted to make this post to express some gratitude towards those shareholders that submitted a proposal, despite that GameStop rejected them.

It's really easy to criticize. It's very easy to sit behind a keyboard and put other people down while otherwise contributing nothing. It takes almost no effort to do this.

It's hard to build things, it's much easier to destroy things.

Those shareholders th

some more data going back to fiscal year 2005.

| Fiscal Year | Revenue | Net Income | Store Count | Revenue Per Store | Net Income Per Store | 10-K |

|---|---|---|---|---|---|---|

| 2005 | $3,091,783,000 | $100,784,000 | 4490 | $688,593.10 | $22,446.33 | link |

| 2006 | $5,318,900,000 | $158,250,000 | 4778 | $1,113,206.36 | $33,120.55 | link |

| 2007 | $7,093,962,000 | $288,291,000 | 5264 | $1,347,637.16 | $54,766.53 | link |

| 2008 | $8,805,897,000 | $398,282,000 | 6207 | $1,418,704.20 | $64,166.59 | link |

| 2009 | $9,077,997,000 | $377,265,000 | 6450 | $1,407,441.40 | $58,490.70 | link |

| 2010 | $9,473,700,000 | $408,000,000 | 6670 | $1,420,344.83 | $61,169.42 | link |

| 2011 | $9,550,500,000 | $339,900,000 | 6683 | $1,429,073.77 | $50,860.39 | link |

| 2012 | $8,886,700,000 | -$269,700,000 | 6602 | $1,346,061.80 | $40,851.26 | link |

| 2013 | $9,039,500,000 | $354,200,000 | 6675 | $1,354,232.21 | $53,063.67 | link |

| 2014 | $9,296,000,000 | $393,100,000 | 6690 | $1,389,536.62 | $58,759.34 | link |

| 2015 | $9,363,800,000 | $402,800,000 | 7117 | $1,315,694.82 | $56,596.88 | link |

| 2016 | $8,607,900,000 | $353,200,000 | 7535 | $1,142,388.85 | $46,874.59 | link |

| 2017 | $9,224,600,000 | $34,700,000 | 7276 | $1,267,811.98 | $4,769.10 | link |

| 2018 | $8,285,300,000 | -$673,000,000 | 5830 | $1,421,149.23 | $115,437.39 | link |

| 2019 | $6,466,000,000 | -$470,900,000 | 5509 | $1,173,715.74 | $85,478.31 | link |

| 2020 | $5,089,800,000 | -$215,300,000 | 4816 | $1,056,852.16 | $44,705.15 | link |

| 2021 | $6,010,700,000 | -$381,300,000 | 4573 | $1,314,388.80 | $83,380.71 | link |

| 2022 | $5,927,200,000 | -$313,100,000 | 4413 | $1,343,122.59 | $70,949.47 | link |

nice post OP! love your original art.

it often takes me a while to figure out what it says when looking at the static images. this one took me a solid 2 minutes.

TERMINATE DSPP!

Another example, January 29, 2024.

Why do they do this shit? What possible benefit do the moderators of superstonk get by posting this? Why are they trying so hard to stay in control of the narrative? Why do they act as if they are an authority on this topic?

sorry, correction, not ALL of the information in the chart was exclusively from that section of the 10-Q, there was also this section of the revenue:

all in all it was a decent movie.

"but it doesn't talk about [insert thing here] so therefore it was not good!"

i disagree with that notion. no such thing as bad press, and all that, and this movie isn't even bad press. it was fun and entertaining, which is typically the purpose of most movies. it was not a fact-based documentary, it's hollywood entertainment that is shining a light on an important story.

i do find it funny how much hate the movie is getting in superstonk.

In any kind of situation, sorry if I sound like a broken record here, but I always ask myself: who benefits?

We know that Public Relations is something that exists as an industry and as a component of businesses. Businesses use PR in order to shape public perception, away from something negative and sensitive to the business and towards something positive and helpful for the business.

E.g.: what did tobacco / cigarette companies do when research started coming out demonstrating that cigarettes caused cancer? Were those companies honest and forthright, and admit to this true reality even though admitting it would hurt their sales? Or did they do everything in their ability to obfuscate the truth and confuse people, because those actions led to an outcome of continued profits for the company?

We know that wall street and other industries make use of shill farms. Shill farms are basically the modern evolution of PR. If you are a wealthy and powerful incumbent and you are not using shill farms, you will fall behind and lose control of the narrative.

so, in a contest of "promote Dumb Money because it brings positive attention to GameStop", versus "Dumb Money sucks and was bad and was not good and I hated it and it didn't properly represent the story", which one of these thought processes is helpful to GME investors and which one is not?

And in consideration of that, why is it that superstonk is so loaded with antagonism towards this movie?

I think you might be right, though it is impossible to know for sure.

Like how the price started pumping a few days prior to December 6 earnings because those earnings were going to be decent and cause a positive reaction. So they get ahead of the positive reaction by preemptively pumping it beforehand for the purpose of preventing or slowing any momentum. This is what i suspect happened and may happen again in March of this year prior to earnings date.

Another kind of example of the censorship and confusion on this topic that continues to happen to this very day. It is for this reason why the subject needs to be repeatedly discussed and understood by as many GME shareholders as possible, because to this very day they continue to censor and confuse this topic to varying degrees.

January 23, 2024: a post that provides good information about the distinction between DRS and DSPP numbers gets removed from superstonk.

Even if well intentioned, posts like these ultimately are encouraging selling of shares, turning off autobuys, and sowing distrust in ComputerShare. The sources provided don’t back up these claims and how one person is interpreting this does not mean it’s fact. Please do your own due diligence when it comes to making decisions for your investment. Rule 6.

Why is this topic so contentious? Why has there been a sustained campaign to censor and confuse this specific topic, the topic of the distinction of DSPP and DRS, the fact that plan is not DRS?

Who benefits if it is crystal clear and all GME investors understand the truth? GME investors benefit. Who benefits if it is confusing and controversial and omitted (censored) from conversation? Not GME investors.