Die Inflation in Deutschland ist auf den niedrigsten Stand seit fast drei Jahren gefallen. Vor allem dank sinkender Energiepreise lag die Teuerungsrate im März bei 2,2 Prozent.

Du weißt doch, Deutschlandtempo und so.

Ok ja ist passt, es gefällt! 😎

Sieht ganz schön aus! Eine feddit-Referenz passt nicht drauf, oder?

Waah ich hab’s verpasst, meine -42 Tabs tauchen in der Statistik nicht auf 🙈 hammer Auswertung! 🔨

Absolutely gorgeous, thanks for sharing!

Größter Schock meines Lebens war beim Dönermann im Pott: „Kräutersoße haben wir nicht, willst du Tzatziki?“ Musste notgedrungen auf Currywurst umgleisen 😖

So fluffy 😍

🥳🍾

I am a bit too dumb to understand that graph and asked ai for an explanation. It helped me, maybe it also helps others:

This graph comes from a study by Gilens and Page that examines how different groups influence U.S. policy decisions. It has three separate charts, each showing how policy adoption (whether a policy is enacted) relates to the preferences of different groups:

1 Average Citizens’ Preferences (top chart)

2 Economic Elites’ Preferences (middle chart)

3 Interest Group Alignments (bottom chart)

Breaking It Down:

• X-axis:

• In the first two graphs, it represents how much each group supports a policy (from 0% to 100%).

• In the third graph (Interest Groups), the x-axis shows alignment, with negative values meaning opposition and positive values meaning support.

• Y-axis:

• The left y-axis (dark line) shows the predicted probability of a policy being adopted.

• The right y-axis (gray bars) shows how often different levels of support occur in the data (percentage of cases).

Key Takeaways & Surprises:

1 The top chart (Average Citizens) is nearly a flat line.

• This means that whether the general public strongly supports or opposes a policy has little impact on whether it gets adopted.

2 The middle chart (Economic Elites) has a rising curve.

• This suggests that policies supported by the wealthy have a much higher chance of being adopted.

3 The bottom chart (Interest Groups) also shows a strong upward trend.

• The more interest groups align in favor of a policy, the more likely it is to be adopted.

Big Picture:

This graph suggests that the opinions of average citizens have little to no effect on policy decisions, while economic elites and interest groups have significant influence. This challenges the idea that the U.S. operates as a true democracy where the will of the majority decides policy.

Permanently Deleted

Hard to compete with that 90s confidence 😎

Permanently Deleted

„It‘s totally a lot smarter than I am, no way could I deliver (234 * 534)^21 as confidently!“

I want those fuckers powering little submarines that fight cancer cells right now - but realistically speaking, these microcontrollers would need to be at least one order two order of magnitude smaller for that, no?

Ich will nicht lügen, das ist ein ziemlich mieses Maimai. Aber auf die Aussage können wir uns einigen 🤝

Tanz in den Fünfhundertdrei!

Fick ja!

bedankt!

Ya interesting, your theory of mind checks out for me. I'm not "rich" as in "I have significant capital", but I'm certainly more "rich" than "poor". So yes, I don't notice it when I pay ~30EUR per month for a newspaper.

Are there any independent newspapers in your country? I Germany, there's taz, a daily newspaper that is owned by a cooperative. They certainly don't give a shit about the rich & powerful's opinion - for example, they publicly pissed off the editor-in-chief of Germany's biggest and most-powerful news corporation, Springer, just for the sake of free speech. Would you be willing to give money to that kind of newspaper?

Zu sehen ist richtig mies-böses Bubatz, dessen Trichome vor Harz nur so triefen.

I see your opinion, I’m curious to hear how you think about the media’s role in society. Journalists work at newspapers and they need to pay rent. A stance “paywalls are paid for by the rich and the stupid” kinda means that one doesn’t want to pay journalists.

I am genuinely curious about your perspective on this. Would you prefer a world without newspapers? Or is it more of a question of money? When I was younger, I didn’t have the money to pay for newspapers. Nowadays, I’m happy to pay for newspapers that interest me.

Every time someone pointed out they hate groups of people, in arbitrary subcategories, they got downvoted.

There, I fixed that for you.

🎨📜Ausgrabungen

Der liebe notastatist hat in Ägypten gegraben und mir ein göttliches Wichtelgeschenk auf Papyrus gemacht. Im Zentrum ist Königsgemahlin Metertari zu sehen. Hab herzlichen Dank 🙏❤️

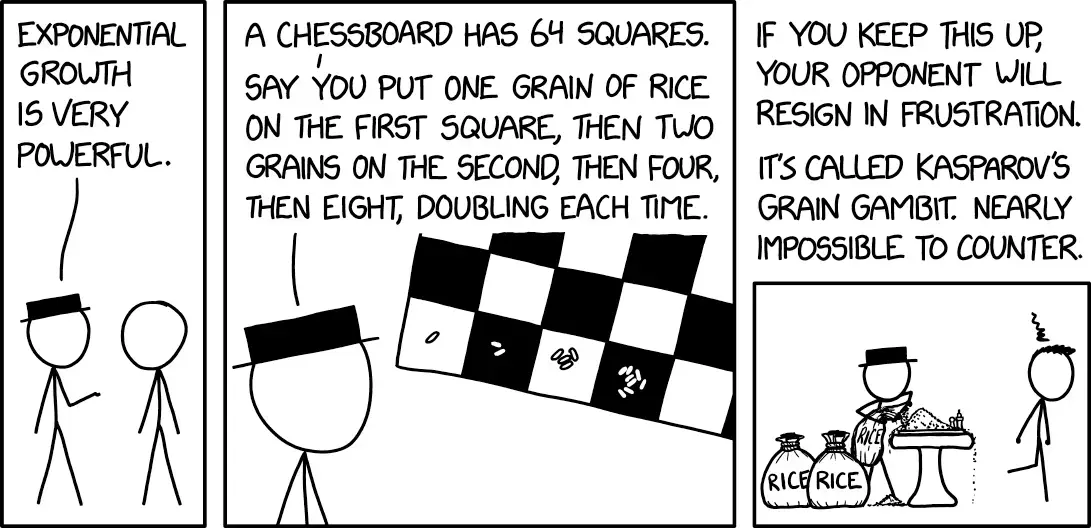

xkcd #2936: Exponential Growth

cross-posted from: https://lemmy.world/post/15745137

xkcd #2936: Exponential Growth

Alt text:

Karpov's construction of a series of increasingly large rice cookers led to a protracted deadlock, but exponential growth won in the end.

2024/03 - Inflation verliert weiter an Tempo

Die Inflation in Deutschland ist auf den niedrigsten Stand seit fast drei Jahren gefallen. Vor allem dank sinkender Energiepreise lag die Teuerungsrate im März bei 2,2 Prozent.

Strompreis für kleine bis mittlere Industriebetriebe für Neuabschlüsse fast auf Vorkriegsniveau

Der durchschnittliche Strompreis für kleine bis mittlere Industriebetriebe für Neuabschlüsse ist weiter deutlich gesunken und liegt zum Jahresbeginn 2024 bei 17,65 ct/kWh. Das entspricht einem Rückgang um 28 Prozent gegenüber dem Jahresmittel 2023 (2023: 24,46 ct/kWh).

[...]

Der Anteil von Steuern, Abgaben und Umlagen ist 2024 geringfügig um 0,36 ct/kWh gegenüber dem Vorjahr gesunken und beträgt nun 12,02 ct/kWh (2023: 12,38 ct/kWh). Ihr Anteil am Gesamtpreis beträgt derzeit 29 Prozent. Der Anteil der Netzentgelte beträgt 27 Prozent, Beschaffung und Vertrieb haben einen Anteil von 44 Prozent.

Quelle: https://www.bdew.de/service/daten-und-grafiken/bdew-strompreisanalyse/

Handelsblatt: Immobilienpreise rutschen in 2023Q4 über alle Segmente hinweg ab

Link zur vdp-Studie hier

Frankfurt. Höhere Zinsen, Inflation, Konjunkturkrise: Die Preise für deutsche Immobilien stehen seit Monaten unter Druck – und die schlechten Nachrichten reißen vorerst nicht ab. Noch nie seit 60 Jahren fielen die Immobilienpreise „so schnell so stark“, schrieben die Forscher des Instituts für Weltwirtschaft (IfW) mit Blick auf das Gesamtjahr 2023 vor wenigen Tagen.

Am Montag veröffentlichte der Verband deutscher Pfandbriefbanken (VDP), der die wichtigsten Immobilienfinanzierer hierzulande vertritt, neue Zahlen: Die Immobilienpreise rutschten im vierten Quartal 2023 über alle Segmente hinweg, verglichen mit dem Vorjahreszeitraum, um durchschnittlich 7,2 Prozent ab.

Was ist gerade am Markt los? Wie schwer ist die Krise? Laut dem Verband gehen die Verschiebungen am deutschen Markt weiter. Die Entwicklung ist dabei je nach Sparte recht unterschiedlich. Ein Üb

Ikano-Bank bietet 4,21% auf Tagesgeld für Neukunden

Tagesgeld bei der Ikano Bank – das ist „Fleks Horten Tagesgeld“, die faire Geldanlage mit einer Top-Rendite. Entdecke jetzt unsere attraktiven Konditionen.

Neuer Höchszins bei der Ikea-Bank: Aktionszins für Neuverträge: Bis zum 31. Juli 2024 garantierte 4,21 %.

Im Anschluss regulärer Zins (derzeit 2,76 %).

https://ikanobank.de/tagesgeld/fleks-horten-tagesgeld

Zinsen werden jährlich gezahlt laut Handelsblatt.

Buying Quality Shoes in Madrid

The Spanish capital boasts a long and unique tradition in menswear, particularly in footwear. Despite Spain's declining production of footwear over the decades, with much of it moving to Asia, Madrilenians still uphold a strong preference for high-quality leather shoes. The zapaterias, as the Spanish call their shoe shops, are concentrated in the old town, around the historical shoemaker's quarter in Caille de Toledo. However, they are omnipresent throughout the city and hard to miss. Let me show you four of my favorite zapaterias in Madrid.

Let's start by exploring the Spanish all-star-shoe, the "Pisamierda", which roughly translates into "sh*t stomper". These shoes, in design similar to Clark's Desert Boots, can be found in almost every Spanish household due to their affordable pricing. For instance, LOBO, a shop in Calle de Toledo, sells a pair mad

Anleihen ETF: steigende Zinsen, fallende Kurse (2022)

Zinsanstieg bei Euro-Anleihen - Stiftung Warentest gibt Tipps für Anleger und Verbraucher.

Artikel aus April 22, heute wieder relevant: Bei einer (bald?) anstehenden Zinswende würden Anleihen-ETF mit mittleren und langen Laufzeiten im Kurs steigen.

Was meint ihr, sollte man jetzt zB den IE00BDBRDM35 kaufen?